Climate change is happening. The impacts can be seen in the more frequent and severe weather events, changes in societal behaviour and expectations with decarbonisation, as well as changes in legislation and shifts in markets. These changes create disruption and uncertainties that are difficult to plan for and put pressure on organisations, their business models, strategies and objectives.

Governments around the globe are introducing legislation requiring entities to report on the climate risks they face and how they are responding. It is mandatory for some medium to large organisations to report on Climate-related Disclosure (CRD) in New Zealand, and Australia is following suit. We see the influence of this mandatory reporting rippling out to entities in their value chains, with many choosing to voluntarily develop their climate reporting and looking at their resiliance in the face of climate change and the need for business transformation

Climate scenario development and analysis is required under the CRD framework and supports an entity to assess how climate-related risks and opportunities could impact its business strategy. By considering different plausible but challenging futures, an entity can gain a deeper understanding of their risks and opportunities. But what comes next?

Under the New Zealand Climate-related Disclosure reporting regime, entities will need to disclose the transition plan aspects of their strategy. This includes how their business model and strategy might change to address climate-related risks and opportunities, and the extent to which these transition plan aspects are aligned with their financial planning processes, including capital deployment and funding.

Transition planning is challenging because there is high uncertainty in the future about how governments and markets will respond to the climate crisis, how rapidly society will transition to a low carbon economy, and how much we will be impacted by climate change. Because of this uncertainty, flexibility is required; however, plans still need to be robust and clear while allowing space for iteration. This is not the typical way of doing things. So how do we make a flexible, iterative plan to respond to uncertain futures?

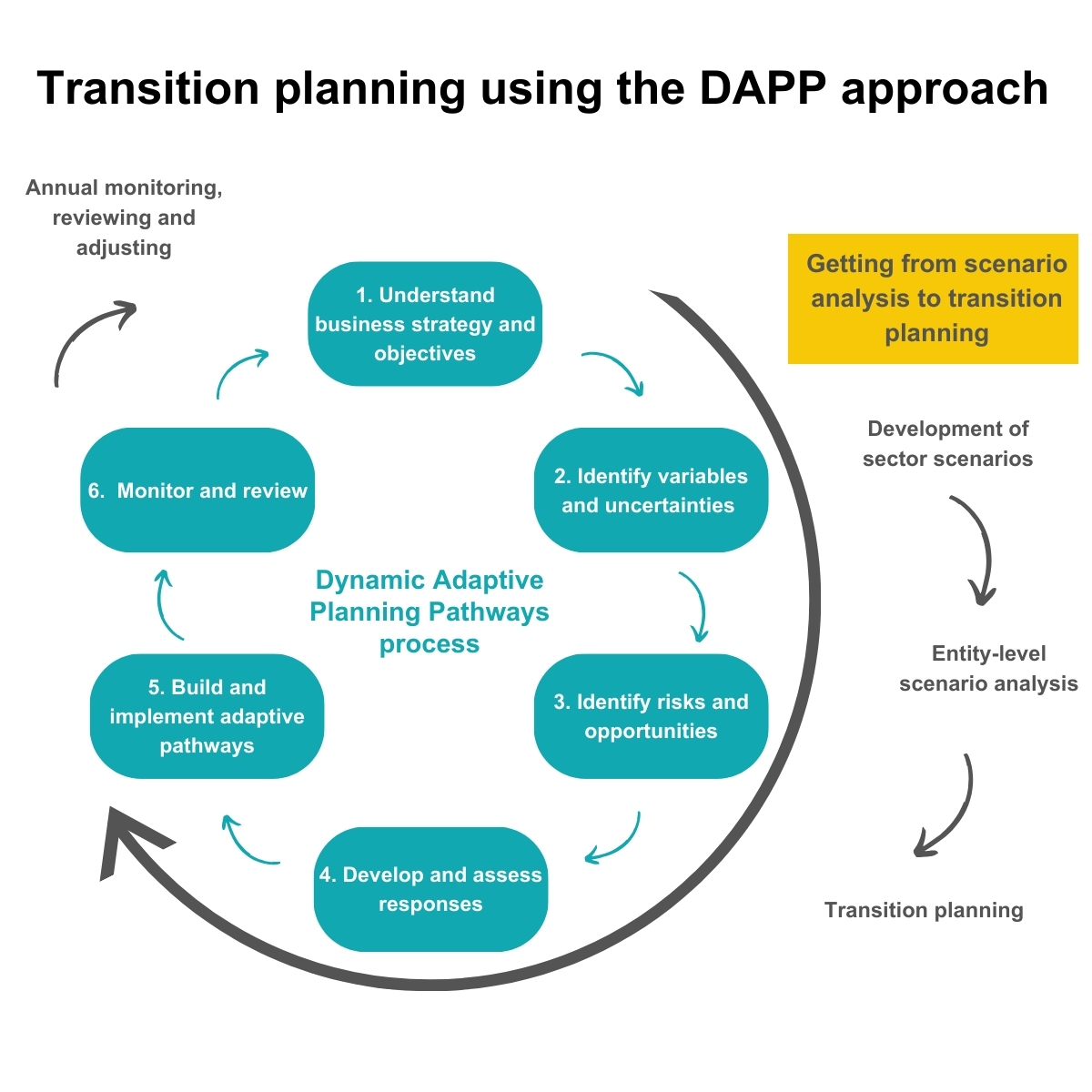

A potential solution: Dynamic Adaptive Planning Pathways (DAPP)

Transition plans can be developed which go beyond “tick the box” compliance, to more effectively inform strategic decision making, provide pathways when change occurs and drive cost-effective outcomes through Dynamic Adaptive Planning Pathways (DAPP).

DAPP provides a scalable way to flexibly plan for investments in climate adaptation for assets and communities. Pathways chart a series of actions in the short, medium and long term, with signals and triggers to indicate the points in time at which decisions are required. The benefit of a pathways approach is that it:

- avoids locking in costly investment decisions that may end up being redundant or not as effective if circumstances change unexpectedly.

- provides a scalable approach which begins with a high-level strategic plan and some no or low regrets short term actions.

- as the transition plan is executed, more detail can be added over time to the strategic plan.

- allows for refining and enhancing short term actions refined and enhanced based on the benefits realised, and expands over time to include decarbonisation, adaption, and nature-positive for example.

DAPP allows for the development of transition plans that enable dynamic decision-making as circumstances change, providing more investment certainty for organisations. The DAPP approach is practical for aligning transition plans with business strategies and objectives that may need to pivot in the face of a changing world and are easily updated within the annual CRD cycle. Monitoring identifies how conditions change and can streamline updates to scenarios, risks and opportunities, or actions clearly tracking external changes as well as organisational action to evaluate progress. As you continue through subsequent iterations of the DAPP process, you begin with understanding what has or has not changed since the previous iteration reducing rework required.

Navigating the complexities of climate-related risk and uncertainty requires a robust and flexible approach. Without a clear process, organisations may struggle to determine which actions will be both effective and a wise long-term investment. A DAPP approach, alongside scenario analysis, allows you to identify where similar actions will provide benefits to your organisation across a range of scenarios. These low-regret actions can be tested and refined to show meaningful action to reduce climate risks, including transition and physical risks, or take advantage of opportunities.

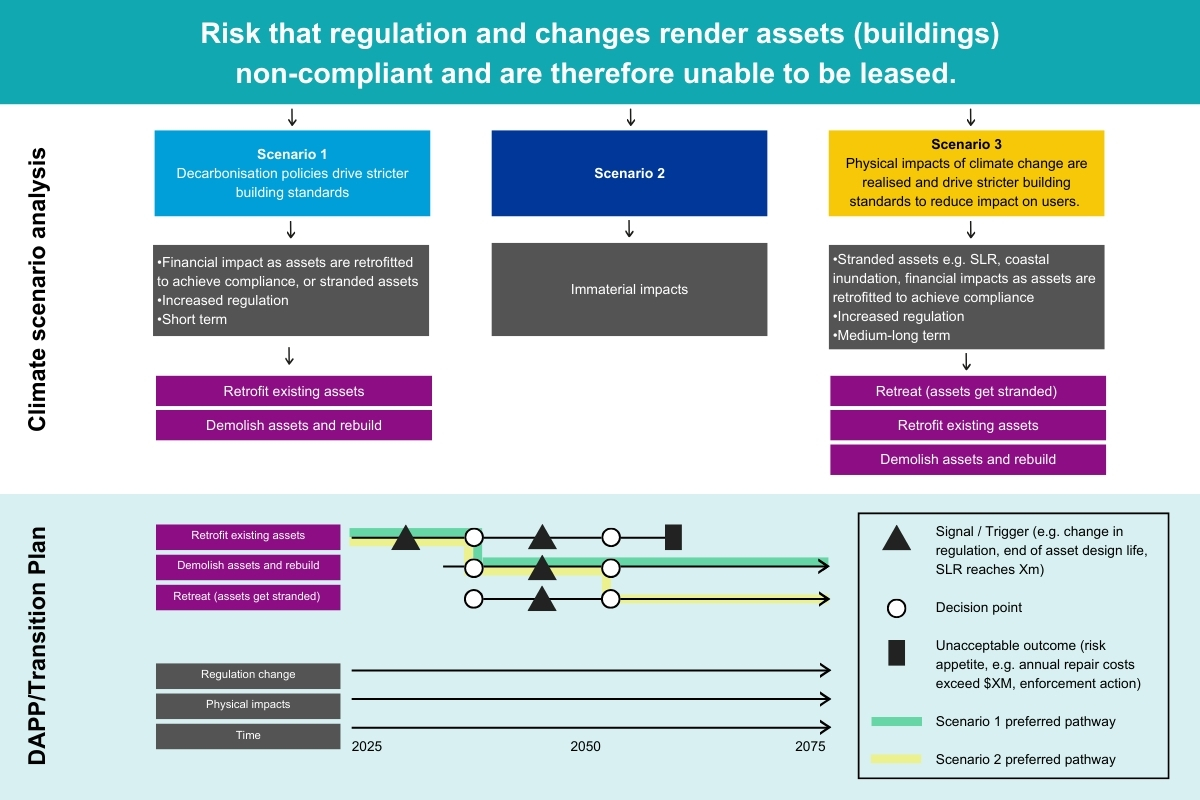

In the figure below, we show how an entity might begin with an understanding of how assets are likely to be impacted under various scenarios with a clear understanding of risks and opportunities. In response to those risks and opportunities, there are clear actions that can be taken. Some of these actions will be similar across scenarios or particularly aligned with organisational strategy. These actions are no or low regrets actions that enable long-term flexibility and benefits. After developing your initial transition plan, and selecting a preferred pathway of action over time, updates in future years track risk reduction or opportunity realisation and allow you to watch for signals alerting you when further change is likely to be required.

If you’ve got questions or are interested in delving into the world of DAPP and transition planning, please get in touch with Kristin Renoux or Laura Robichaux.

Building transition pathways from scenarios – What this could look like: