The pressing demand to act on climate change is not solely environmental. With each natural disaster comes more devastated communities and the financial impact of trying to rebuild, creating an ongoing burden on the economy. The Climate Change Act 2022 received Royal Assent in September; what does this mean for the business community as we seek to meet our sustainability goals?

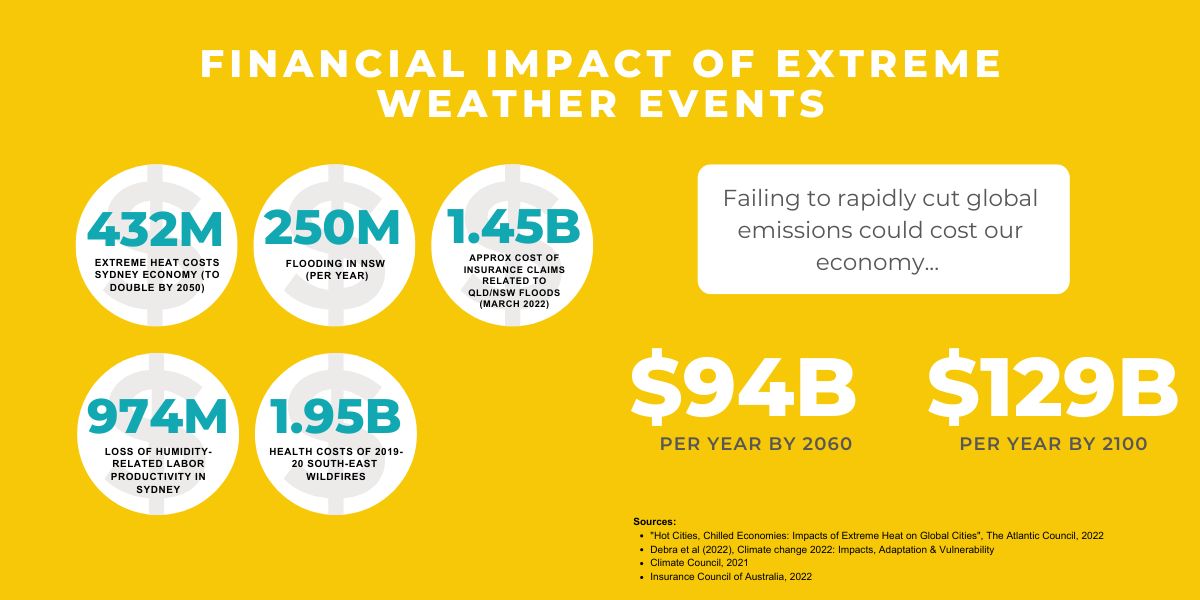

Extreme weather events are now regularly occurring across Australia, including the recent bushfires in early 2020; record temperatures of 50.7 degrees Celsius in Western Australia in January 2022; and unpredictable rainfall events across New South Wales (NSW) causing several floods.

The estimated cost of insurance claims for March 2022 alone due to flooding in Queensland and NSW is $1.45 billion; the infographic below summarises the financial implication of such extreme events for Australia ($AUD):

A recent study predicted that sea-level rise of at least 27cm is inevitable, with increasing frequency of intense rainfall, ice flow discharge and meltwater run-off. Two-thirds of Australians currently reside in the coastal fringes and the population continues to grow in these fragile areas, increasing our vulnerability to sea level rise. Biodiversity extinction is at record high and yet Australia stands at 14th highest emitter from fossil fuels in the world, contributing just over 1% of global emissions [1].

The Climate Change Act 2022 provides a strong signal to the Australian community to act now, particularly in relation to transitioning towards decarbonisation. Whilst it is refreshing to finally have a legislation for climate change in Australia, is it too little too late?

The key components of the Act focus on greenhouse gas reduction (primarily carbon), and climate-related reporting. The latter being a trend that is increasingly affecting our clients, and with a high likelihood of it being mandated soon.

Let’s do a deep dive into these two areas of the Act.

Carbon reduction roadmap

Through the Act, the Australian government revised the reduction target of greenhouse gas emissions from 26% to 43% (below 2005 levels) by 2030, and net-zero by 2050. Considering the nation's current carbon reduction trend, there needs to be an additional 27% reduction below the 2021 level to reach 43% reduction in 2030. For context, Australia is currently on a downward trend of 23% emissions between 1990 and 2021.

Therefore, Australia has eight years to reduce their carbon emissions by more than what was managed in 31 years. This new target is aligned to Australia’s latest Nationally Determined Contribution (NDC) to the global Paris Agreement on climate change. This feels ambitious given the current trajectory, and yet we still have to ask: is it enough to keep us below 1.5 degrees Celsius?

Apparently not, as the Climate Council claims that this new target is insufficient, and Australia needs to triple our emissions reductions efforts by increasing the target to 75% by 2030 and aim to reach Net Zero by 2035. Historically Australia’s carbon reduction has been maintained through reduction in direct emission (Scope 1) [2] and indirect emission (Scope 2) [3]. The Act does not limit the scope under which the reduction will take place, but it is expected that the 43% reduction is likely to come from the energy sector and through electrification (Scope 1 & 2).

Scope 3 emissions comprises embodied carbon, which is the source of both local and international supply chain purchase and transportation. Australian businesses have a huge part to play here, as Scope 3 substantially forms the footprint of the wider economy.

The chances of the Federal target increasing are unlikely, but it is promising to see our State and Local Governments leading the way in setting a much higher and promising target in the race towards Net Zero:

|

State |

Targeted Carbon emission (Based on 2005 levels) |

Few recent initiatives |

|

NSW |

Commitment of $2 billion investment till 2030 to reduce carbon emission. Announced a $360 million Net Zero Industry and Innovation Investment Plan to develop and deploy decarbonisation projects and development of clean manufacturing precincts. |

|

|

Queensland |

30% by 2030. Net Zero emissions by 2050. |

Announced a $4.5 billion Queensland Renewable Energy and Hydrogen Jobs Fund. |

|

Victoria |

50% by 2030 and Net Zero by 2050. |

Committed to invest $1.6 billion in renewable energy sector. 4.5GW of publicly owned renewables in addition to a Victorian Energy Storage Target of 2.6GW by 2030 and 6.3GW by 2035 made recently |

According to the Climate Change Authority, the Australian Government has already committed $24.9 billion over the next eight years towards Australia’s climate and energy initiatives in the latest Budget. However, we are the 19th largest exporter in the world with iron ore, coal, gas and aluminium among our exported products. Our economy is heavily reliant on the export of these products; however, they are emission intensive and pose a challenge to our Net Zero target.

During 2020, the energy sector was the highest carbon emitter in the Australian economy (33%) followed by stationary energy (20%), transport (18%), agriculture (13%), and industrial processes (7%) [5]. Hence, the much focus on the energy sector to provide those emissions reductions with particular focus on electrification and energy efficiency. Renewable-led electrification will be our new reality within the next 25 years, according to New York Times bestseller Jerry Rifkin in “The Third Industrial Revolution”.

We are working with clients to embed sustainable and low carbon design solutions in energy infrastructure (powerlines, grid transmission, battery storage etc), and helping other clients to achieve operational efficiency through decarbonisation solutions.

Climate change statement disclosure

Currently Australian companies disclose their carbon emissions under the National Greenhouse and Energy Reporting (NGER), when they exceed yearly emissions threshold of 50kt CO2e (kilo tons of carbon dioxide equivalent). However, more stringent regulations and audit procedures are needed and are expected to emerge to ensure mandatory reporting of emissions to NGER, regardless of any threshold.

The Taskforce on Climate-related Financial Disclosure (TCFD) is a global reporting framework for organisations to develop more effective climate related financial disclosures through their existing reporting process. This environmental reporting framework is based on four pillars: governance, strategy, risk management and matrix.

The development and adoption of the Taskforce for Nature-related Financial Disclosure (TNFD) is gaining momentum. Our biodiversity crisis is just as critical, as well as intimately connected to our climate crisis, and we need an urgent call for action to address both. The TNFD framework will serve as a structure under which entities can report their impact and dependence on natural ecosystems, and will be aligned to the TCFD approach.

Companies benefit from integrating TCFD reporting with financial impact and risk management procedures and the international support for TCFD is growing rapidly. Considering the TCFD framework will be adopted under accounting standards IFRS S1 and IFRS S2 at the end of this year, Australia may move to make TCFD reporting mandatory in line with domestic regulatory framework, as New Zealand has done. The USA is having a dialogue through their Securities and Exchange Commission (SEC) to make TCFD mandatory for their listed companies.

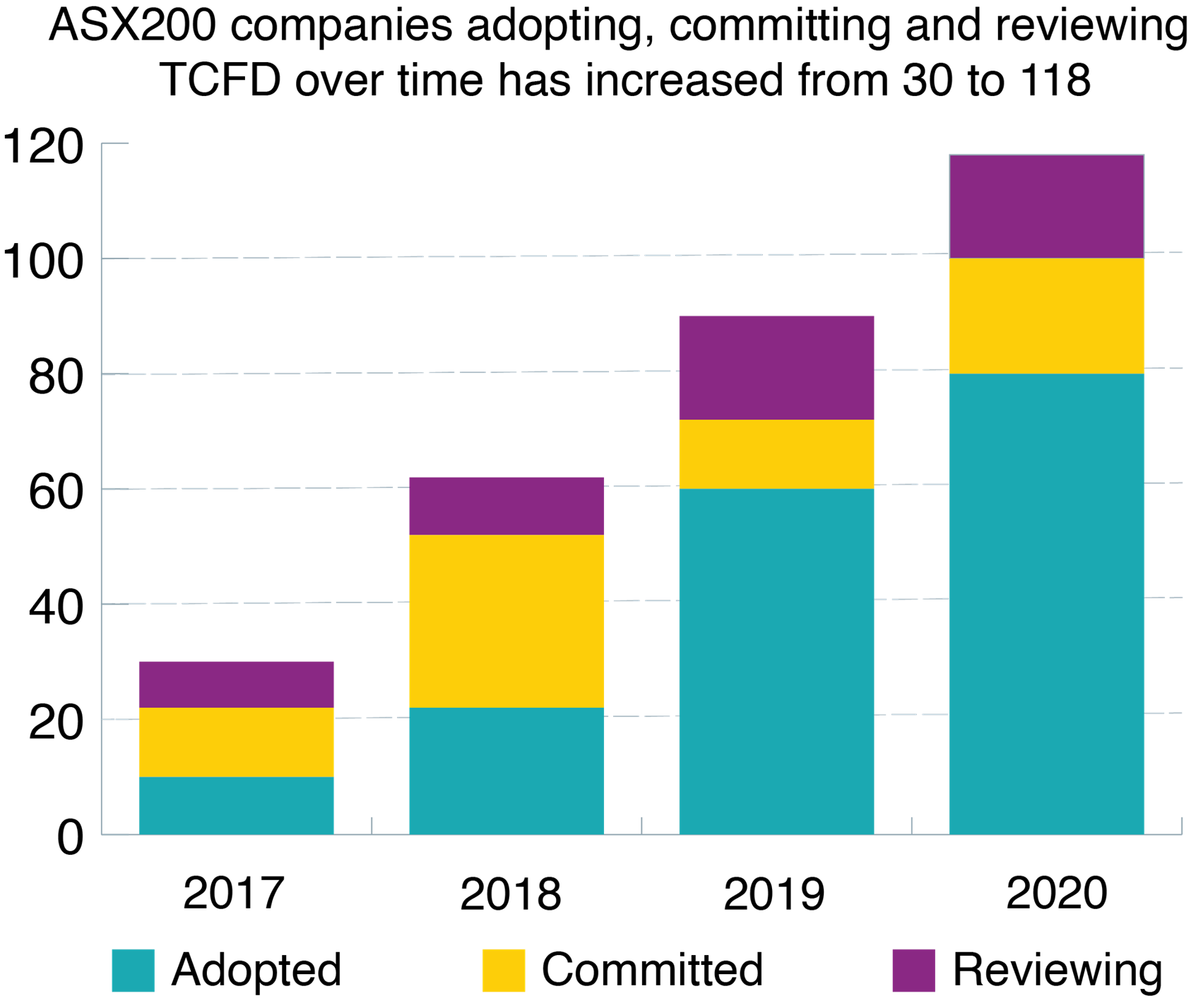

In Australia, 90% of ASX100 companies recognise climate risk as financial risk and 74% are currently reporting against TCFD. Despite the increasing trend in disclosures as shown in the graph below, approximately only half of ASX200 companies report on their Scope 1 and Scope 2 emissions and seek an independent third-party to audit or verify their emissions report. Verification is key to highlight any discrepancies in the emission calculations, identify any bias and provide assurance to stakeholders that the reported emissions are correct.

The ASX Corporate Governance Council recommends that listed entities adopt the disclosure TCFD framework and should disclose whether it has any material exposure to Environmental, Social and Governance (ESG) risks, with supporting risk management plans. The Australian Prudential Regulatory Authority (APRA) finalised TCFD-aligned guidance for bankers, insurers, and superannuation trustees to comply with existing APRA prudential standards relating to risk management and governance.

Graph: Yearly trend against TCFD reporting for ASX200 companies in Australia

Urgent work is needed to implement the Climate Act, such as development of a proper instrument for decarbonisation and climate disclosures. Such tools will enhance transparency and mandate more stringent risk management and reporting procedures. For businesses to future-proof their services and remain competitive in the market, it is critical that they start their transition now irrespective of which stage they are in their race to Net Zero.

[1] CSIRO data

[2] Scope 1 occurs from sources that are controlled or owned by an organization (e.g., emissions associated with fuel combustion in boilers, furnaces, vehicles).

[3] Scope 2 is released from the indirect consumption of an energy commodity (e.g., electricity).

[4] Climate Change Authority.

[5] Australian Council of Superannuation Investors.

Rakibul Hasan

Climate Change & Carbon Accounting - Advisory

New Zealand

New Zealand

Australia

Australia

Singapore

Singapore